If there’s one topic we doubt you’re planning to bring up at your next dinner party, it’d be federal income tax. Talk about a buzzkill. No one (except tax professionals . . . maybe) likes to think about taxes. But it’s important to know how much you’ll need to shell out during the year to keep Uncle Sam off your back. And how do you figure that out? That’s right, federal income tax brackets and tax rates.

Tax brackets and tax rates rise and fall depending on the year and current tax law, and if you’re like most people, you probably don’t follow them too closely. But your budget and spending habits have probably been affected by the same thing that’s affected the 2023 and 2024 tax rates and brackets—inflation! Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income tax.

Tax Brackets vs. Tax Rates

As with most things involving the federal government, the terminology around taxes tends to be more confusing than it needs to be. When you boil it all down, here’s how you tell the difference between tax bracket and tax rate:

A tax bracket is a range of income taxed at a specific rate.

A tax rate is the actual percentage you’re taxed based on your income.

It’s actually simpler than it sounds. Let’s first look at the rates you’ll use to figure out how much income tax you owe Uncle Sam for 2023 and 2024.

Federal Income Tax Rates and Brackets for 2023

The 2023 federal income tax rates will stay the same from 2022. What will change (again) are the income ranges for each 2023 federal income tax bracket, which have already been adjusted for inflation.

2023 Federal Income Tax Brackets and Rates for Taxable Income

Tax Rate

Single Filer

Married, Filing Jointly

Married, Filing Separately

Head of Household

10%

$0–11,000

$0–22,000

$0–11,000

$0–15,700

12%

$11,000–44,725

$22,000–89,450

$11,000–44,725

$15,700–59,850

22%

$44,725–95,375

$89,450–190,750

$44,725–95,375

$59,850–95,350

24%

$95,375–182,100

$190,750–364,200

$95,375–182,100

$95,350–182,100

32%

$182,100–231,250

$364,200–462,500

$182,100–231,250

$182,100–231,250

35%

$231,250–578,125

$462,500–693,750

$231,250–346,875

$231,250–578,100

37%

Over $578,125

Over $693,750

Over $346,875

Over $578,1001

Federal Income Tax Rates and Brackets for 2024

It’s never a bad idea to plan ahead, especially when it comes to anything tax related. Let’s take a look at the tax rates and brackets for the 2024 tax year, which you’ll file during the 2025 tax season. As everyone expected, the IRS adjusted the 2024 rates for this crazy inflation we’re facing. Fun times!

2024 Federal Income Tax Brackets and Rates for Taxable Income

Tax Rate

Single Filer

Married, Filing Jointly

Married, Filing Separately

Head of Household

10%

$0–11,600

$0–23,200

$0–11,600

$0–16,550

12%

$11,600–47,150

$23,200–94,300

$11,600–47,150

$16,550–63,100

22%

$47,150–100,525

$94,300–201,050

$47,150–100,525

$63,100–100,500

24%

$100,525–191,950

$201,050–383,900

$100,525–191,950

$100,500–191,950

32%

$191,950–243,725

$383,900–487,450

$191,950–243,725

$191,950–243,700

35%

$243,725–609,350

$487,450–731,200

$243,725–365,600

$243,700–609,350

37%

Over $609,350

Over $731,200

Over $365,600

Over $609,3502

How Do Federal Income Tax Rates Work?

Here in the U.S., we have what’s called a progressive tax system. Basically, that means the more money you make, the more you’re going to be taxed on that income.

So, how do you know what rate you’ll be taxed at? This is where tax brackets come in. Your taxable income gets divided into the income ranges—or brackets—we talked about earlier, with each range getting taxed at a certain rate. Remember, your taxable income is your income after you’ve subtracted any deductions, which lower your taxable income.

Taxes don’t have to overwhelm you. See what’s best for your situation—and services you can trust.

The good news is that whatever bracket you find yourself in, you don’t have to pay that percentage on your entire income—just the portion that lands in that range. The rest of your income is taxed at the lower rates for each bracket that your income fills up.

Let’s say you’re married filing jointly with $110,000 in taxable income. Roughly the first $23,000 of that income will be taxed in the first bracket. Then the next $71,000 or so will be taxed in the next bracket. Then the next portion will be taxed in the next bracket. You get the idea.

How to Calculate Your 2023 and 2024 Federal Income Tax

If you’re looking at those tables and thinking, What in the world does any of this mean?—don’t worry! The first thing to remember is that the rates on the table only apply to your taxable income. So take out deductions before you start doing the math.

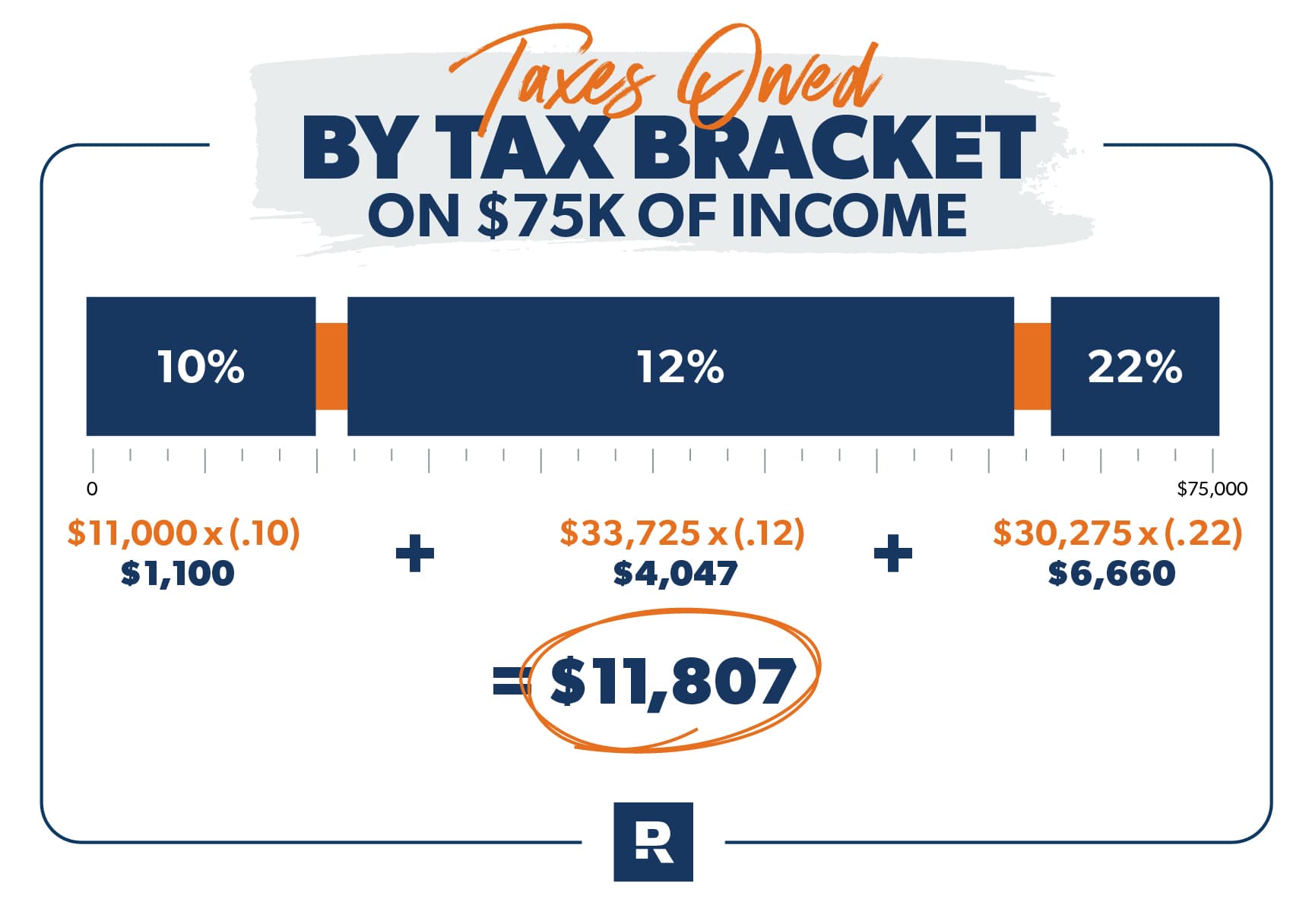

Here’s an example: Let’s say you’re a single filer who made $75,000 in 2023. We’ll leave any deductions out of the equation for now.

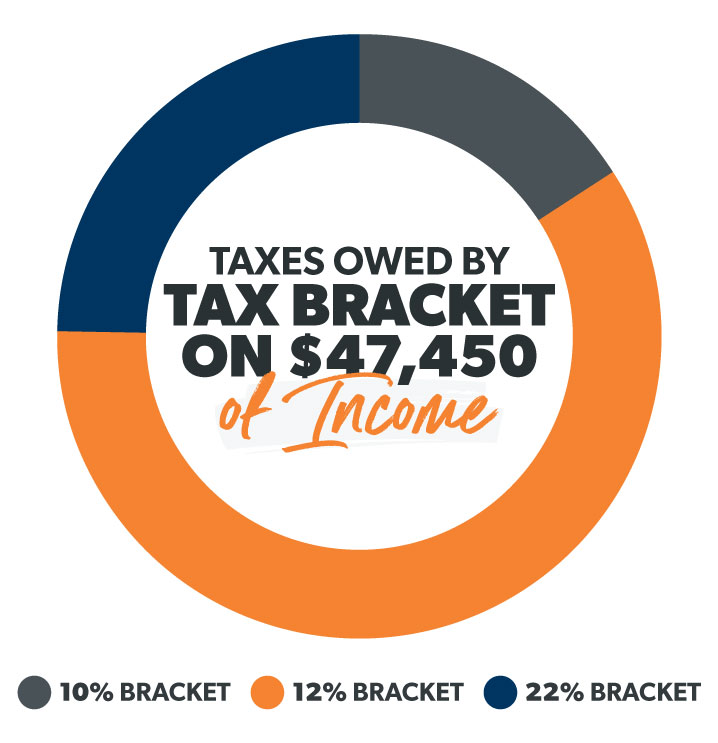

Now, if you give that tax chart another look, you’ll notice that $75,000 falls into the 22% bracket. But the whole amount isn’t going to be taxed at 22%—just a portion of it. Here’s how it breaks down:

Your first $11,000 is taxed at 10%. That’s $1,100.

Your next $33,725 ($44,725 – $11,000) is taxed at 12%. That’s $4,047.

After that, you have $30,275 left that falls under the 22% tax bracket. So $30,275 x 22% = $6,660.

Added up, you owe Uncle Sam a total of $11,807.

And remember that these are the federal income tax rates. Some states might have either a flat income tax, different tax brackets, or no income tax at all.

Oh, and don’t forget to claim any tax credits you might be eligible for after you find out how much you owe in taxes! Tax credits are extremely valuable because they lower your tax bill dollar for dollar.

For example, the child tax credit allows taxpayers to claim up to $2,000 per qualified child. So in the scenario above, if you had one child under 17 years old, you could claim that credit and potentially knock your tax bill down to $4,617.2

File Your Taxes With Confidence

If the idea of doing all this tax math has you running for the hills, we get it. It can be a lot to figure out. The great news is that you don’t have to crunch the numbers all by yourself.

A RamseyTrusted tax pro can walk you through the process from beginning to end so you can conquer your taxes with confidence! And that’s definitely something you’ll feel like sharing at your next dinner party.

Find a tax pro today!

Maybe your taxes are simple enough to handle on your own. Great! Say hello to Ramsey SmartTax—the tax software designed with you in mind!

With Ramsey SmartTax, you’ll always know right up front how much you owe when you e-file your taxes. No hidden fees, no gimmicks, no games.

Check out Ramsey SmartTax today!