Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Back in late summer, the U.S. unemployment rate jumped to 4.3% in the July reading published in August—up from the cycle low of 3.4% in April 2023. That labor market softening, which was enough to trigger recession indicators like the Sahm Rule, unsettled financial markets. In response, markets lowered their economic outlooks, briefly putting downward pressure on long-term yields and mortgage rates. As a result, the average 30-year fixed mortgage rate, as tracked by Mortgage News Daily, hit a 16-month low of 6.11% on September 11, 2024.

However, those economic jitters soon faded as the unemployment rate for September and October slipped back down to 4.1%. With fears of a potential break in the labor market subsiding, long-term yields and rates climbed again, pushing the average 30-year fixed mortgage rate to 6.93% as of November 25.

That raises the question: What if anything can get mortgage rates to come back down?

Based on recent data, the key factor to watch moving forward appears to be the labor market. As we observed this summer, a scenario in which the unemployment rate rises more than expected is also the scenario where mortgage rates are likely to decline the most.

Long-term yields, such as the 10-year Treasury yield, and mortgage rates are not directly set by the Fed’s short-term rate policy. Instead, long-term rates are heavily influenced by investor expectations about future economic conditions, including the labor market, economic growth, inflation, and Fed policy.

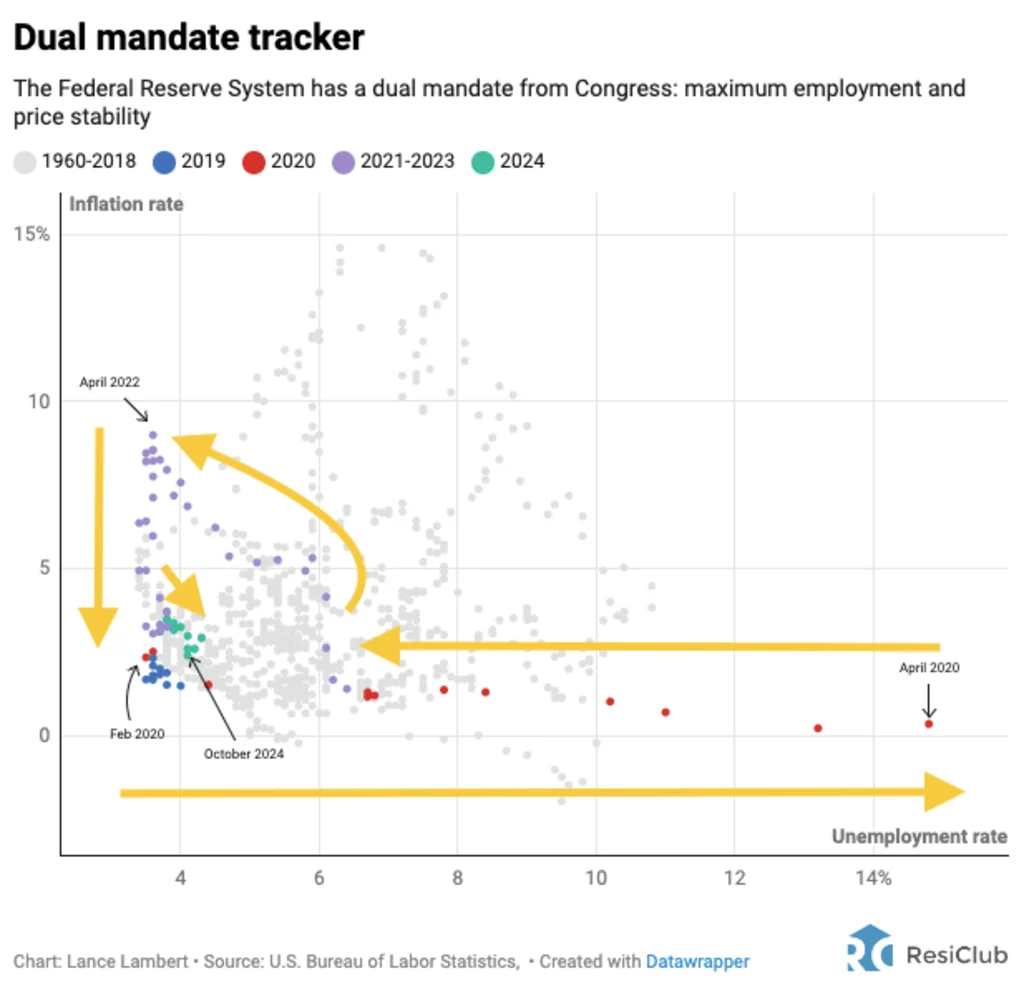

To get a sense of where long-term rates might be headed, keep an eye on the components of the Fed’s Dual Mandate Bullseye and how they are shifting.

As it stands today, the U.S. unemployment rate (4.1%) is within the Fed’s Dual Mandate Bullseye, while the inflation rate (2.6%) is just slightly outside the Fed’s Dual Mandate Bullseye.

Regionally, the unemployment rate remains below 5.0%—the traditional rule of thumb for full employment—in 46 states, with the exceptions being Nevada (5.7%), California (5.4%), Illinois (5.3%), and Kentucky (5.0%).

How does the Fed view the current economic picture?

“I view the economy as being in a good position,” Federal Reserve Governor Lisa Cook said while speaking at the University of Virginia last week, noting that, while core inflation remains somewhat elevated, inflation is down from its 2022 peak and unemployment remains low. “Economic growth has been robust this year, and I forecast the expansion will continue,” Cook added. “Looking ahead, I remain confident that inflation is moving sustainably toward our 2.0% [inflation] objective, even if the path is occasionally bumpy. Meanwhile, I see employment risks as weighted to the downside, but those risks appear to have diminished somewhat in recent months.”

Still, Cook noted that unemployment was an area to watch. “The broader trend I see is that national job growth is solid but perhaps not quite strong enough to keep unemployment at the current low rate,” Cook said. “Net hiring so far this year is running somewhat below estimates for what economists call the breakeven pace, or the rate of hiring needed to keep the unemployment rate constant, when accounting for changes to the size of the labor force.”

If the labor market were to weaken further and unemployment were to rise, it could exert downward pressure on mortgage rates. Regardless of additional weakening in the labor market, another way mortgage rates could decline is if volatility in financial markets eased and the spread between the 10-year Treasury yield and the 30-year fixed mortgage rate—currently at 263 basis points (bps)— narrowed toward the historic average of 175 bps. The average 30-year fixed mortgage rate, currently at 6.93%, would be 6.05% today if the spread fully compressed back to its historic average.