The word budget can get a bad rap. People think budgets are hard, time-consuming and restricting. But listen: The budget life is so worth it.

Budgeting doesn’t tell you not to spend. It gives you permission to spend the right way—to show your money who’s in charge. (You.)

And with EveryDollar, it’s way easier. Ready to start? Let’s break down the steps and learn how to create a budget with EveryDollar.

What Is a Monthly Budget?

First, let’s start with a solid definition of budgeting. Your monthly budget is just a plan for your money. Every dollar. Every month. When you create a monthly budget, you tell your money where to go so you’re never again left wondering where it went.

You can create your budget in a spreadsheet, on a piece of paper, or the best way—with EveryDollar.

Budget Step 1: Enter Your Income

The first step to create your monthly budget is simple: Enter your income. Income is any money you plan to get during that month—that means your normal paychecks and any extra money coming your way through a side hustle, garage sale, freelance work and the like.

Here’s how you enter your income in EveryDollar:

Click Add Income.

Label the income as Paycheck 1, Paycheck 2, Side Hustle Money, or with your employer’s name—whatever works for you!

Click the Planned amount and add in a planned dollar amount.

Repeat that process with all the income you (and your spouse, if you’re married) will earn in a month.

If you have an irregular income, you can still do this! Just put the lowest estimate of what you normally make in this spot. And check out the new paycheck planning feature in the premium version of EveryDollar. It makes budgeting way easier for irregular incomers, just like you!

Budget Step 2: List Your Expenses

Now that you’ve planned for the money coming in, you’re ready for step two—planning for the money going out. It’s time to list your expenses.

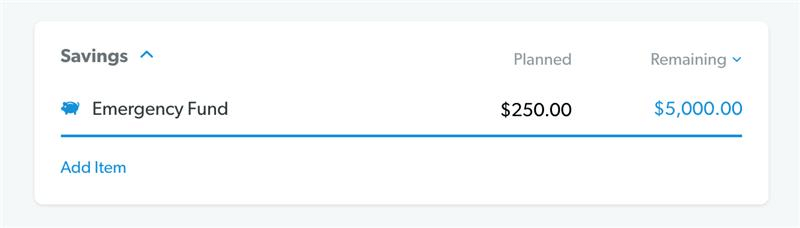

Before you jump into the bills and other expenses, set aside money for giving. We believe in 10% of your income here. And if you don’t have an emergency fund yet, make savings one of your priorities.

Cover your Four Walls.

Focus on covering your Four Walls after that: food, utilities, shelter and transportation. In other words, you feed your family, keep the lights on, pay the rent or mortgage, put gas in the car, and keep the car running.

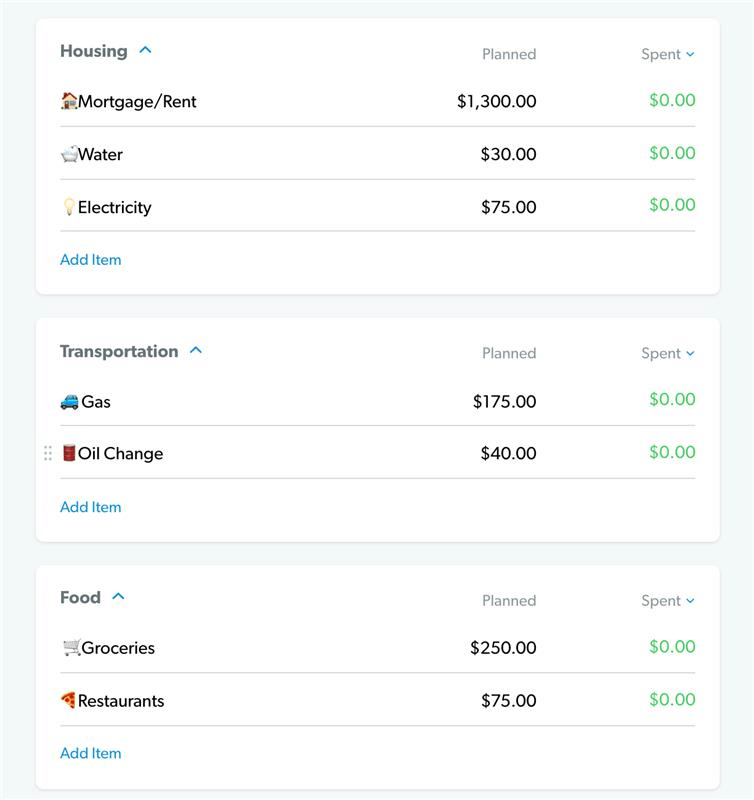

In EveryDollar, you’ll cover your Four Walls inside the Housing, Transportation and Food budget categories. Under each category, you’ll want to add budget lines by clicking Add Item and naming the line. (You can even use emojis! Hey, who says budgeting isn’t fun?)

Check out our example budget below to see common budget lines for each of these categories.

Some of these budget lines are easy to plan for because they’re what’s called a fixed expense—aka you pay the same amount every month. Your rent or mortgage, for example, is probably a fixed expense.

Other expenses change month to month, like how much you spend on gas. Don’t worry. You can log into your online banking and look over the past couple of months. What do you usually spend on that expense? Make a good estimate based on past spending and put that into the Planned amount.

Do this for any food, utilities, shelter and transportation expenses you pay each month.

Then list all other monthly expenses in EveryDollar.

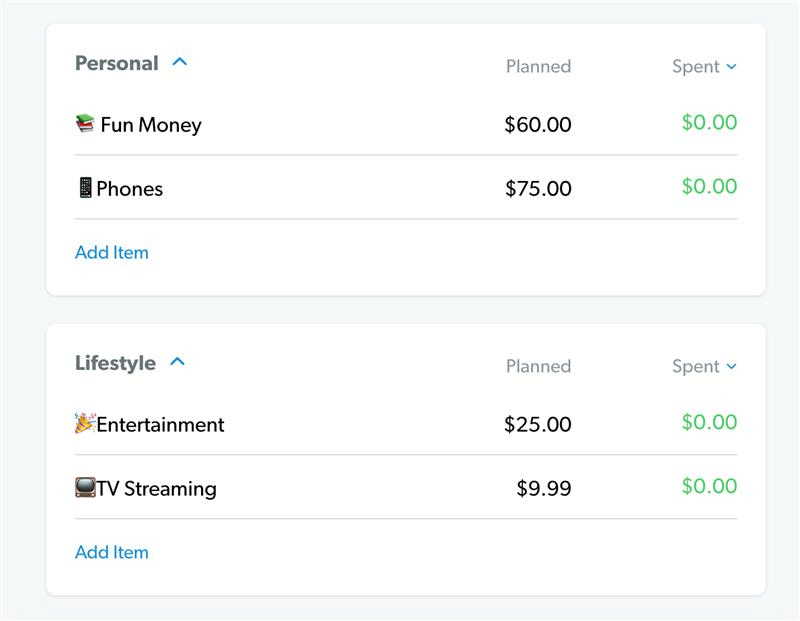

Next, you need to list out all your other monthly expenses. Start with the essentials like insurance, debt and childcare. Then work in a miscellaneous line and any entertainment and fun money (sometimes called personal spending). In EveryDollar, you’ll see these categories: Personal, Lifestyle, Health, Insurance and Debt.

![]()

Start budgeting with EveryDollar today!

Again, create the budget lines you need under each. Start with fixed expenses before filling in estimated planned amounts on any of the rest.

Okay now—here’s an important callout. Very. Important. If you’ve got debt, you shouldn’t be piling money into an entertainment or restaurant budget line. You need to cut back on all the extras until you’ve kicked debt out of your life. Forever.

Why? Debt steals this month’s income to cover something in the past. It’s like taking two steps forward with your money only to be yanked back again. Get rid of the debt. Then you’ll free up money each month to do what you want instead of what your debts demand.

Budget Step 3: Subtract Expenses From Income

When you’ve got all those expenses in your monthly budget, you need to subtract them from your income. (And guess what—EveryDollar does this for you automatically as you fill in your budget lines! Heck yeah.)

If you have money left when you’ve subtracted all your expenses, put it toward your current money goal, like saving or paying off debt. If you end up with a negative number, you need to cut some expenses.

Your goal is to make a zero-based budget—aka all your income minus all your expenses equals zero. So, if you make $5,200 a month like our sample budget, you’re giving all $5,200 a job—paying bills, saving money, paying off debt, and living life!

To help you know when you’ve reached zero, we announce it proudly at the top of your screen: It’s an EveryDollar Budget! If you see that, celebrate. You just budgeted to zero.

Now, and this important, your bank account should never hit zero. Keep a little buffer in your checking account of about $200 for extra safety.

Budget Step 4: Track Your Transactions

We’ve got good news and bad news. The bad news is, you can’t create a monthly budget and leave it alone. Like a sloth hanging from a tree limb, it’ll do nothing for you. The good news is, we’ve got the secret to staying on top of your budget. Track. Your. Expenses.

When you buy something, when you pay a bill, when you spend money at all . . . you need to put those expenses in your budget. That way you’ll know exactly how much you have left to spend.

Tracking expenses is a great way to stay accountable, to yourself and your budget! Also, if you’re married—both of you should use one EveryDollar account so you’re both getting the full view of your shared budget.

Do this throughout the month—not just at the very end. Then you’ll know when to adjust to keep yourself from overspending.

Tracking your transactions is one of the single most important ways you’ll keep up with that monthly budget. It’s how you’ll truly take control of your finances.

Do this in EveryDollar by tapping the Transactions icon, then the plus button. You can add all your transaction info and select the right budget line. Track as you make a purchase, once a day, once a week, or whatever rhythm keeps you from forgetting!

Budget Step 5: Create a New Budget Each Month

Budgeting isn’t a one-and-done situation. It’s more of a lather, rinse and repeat. Here are two of the biggest takeaways you need to know about step four.

Budget every month, before the month starts.

Why? Because thinking ahead is how you get ahead in life and with money.

With EveryDollar, it’s easy. You just copy the previous month over and tweak what you need to.

Don’t forget about month-specific expenses.

But wait, what does “tweak” mean when you create a monthly budget? Well, after you copy over the previous month’s budget, get out your social calendar. Is it your BFF’s birthday? You’ll need a spot in the budget for that present.

Then think about other needs coming this month. Does your car need an oil change? Do the kids need seasonal clothing because the weather’s changing and they just keep growing? (Outgrowing their clothes is one thing kids do best.)

You’ll probably miss something because you can’t see the future, after all. But you can plan what you know is coming and have a miscellaneous line for any surprises.

EveryDollar’s Zero-Based Budget vs. the 50/30/20 Rule

Here’s why EveryDollar is built on the zero-based budget method instead of the 50/30/20 rule, which sets all monthly spending and saving into three categories: needs (50%), wants (30%) and savings (20%).

The biggest problem with the 50/30/20 rule is that it leaves only 20% of your income for savings, retirement and extra debt payments. Minimum payments on debt are considered a need and put in that 50% section, but if you want to pay anything above that, it’ll come out of the last 20% that’s set aside for savings.

That kind of thinking makes for very slow progress toward your money goals. Like snail-like kind of progress. If you’re in debt, throw more than 20% of your income at those payments, so you can crush debt for good. With a gazelle-like kind of speed. After that, you can move on to saving and investing.

Remember, when you use the zero-based method, any money left over after you budget for all your expenses goes toward your current Baby Step. You aren’t stuck at only 20%. And you aren’t throwing money at three goals at once. You’re tackling your money goals one at a time and focusing all your intensity on getting them done.

Things to Remember When Making Your EveryDollar Budget

Listen up, if you’re the type of person who procrastinates, put off something less important—like flossing. But never put off your budget. And while you’re working on that monthly budget, remember these four tips.

Adjust your monthly budget when needed.

Maybe you thought a budget was something set in stone. Well. It isn’t.

Don’t be afraid to adjust your budget throughout the month. It’s actually a huge key to being a successful budgeter.

If your electricity bill is higher than what you planned, adjust. Then find that money somewhere else in the budget. Maybe your water bill was lower. Or maybe you have to lower your restaurant spending to make up for it. Adjust to make it work. Just make sure you aren’t overspending on the extras. Needs. Come. First.

Save for large or semiannual expenses each month.

Not every expense in your life happens on a regular, monthly routine. You should use a sinking fund to save up for these bit by bit. For example:

If your car’s engine isn’t looking so hot, start saving for the repairs.

If your insurance premium is due twice a year, divide the cost and save each month.

If you’ve got a pet, save some each month for Sir Fluffyton’s annual shots and vet visit.

These are all great examples of when you’d need a sinking fund: to budget for large expenses or to spread out the cost of semiannual expenses.

P.S. One of the many awesome benefits of EveryDollar is the fund feature. This lets you easily get ready for these expenses and track your savings as you go—right inside the app.

Give yourself some grace as you work on your monthly budget.

Remember learning to ride a bike? We don’t either. But think about some skill you do remember learning. It kind of sucks at first, right? You aren’t good at it. But that’s okay. That’s why they call it learning and not knowing.

Just like learning any new skill, budgeting requires a little bit of practice and patience to get right. And we know you can do it! For most users, it takes about three months to go from clumsy to comfortable. But just like the bike, eventually you’ll be so good at it you’ll forget all about the bumpy learning experience and move forward in confidence.

Track your transactions quicker with bank connectivity.

Tracking your expenses—aka tracking your transactions—isn’t hard. But it can be time-consuming. That’s why you should check out the premium version of EveryDollar, which gets you that paycheck planning feature we already mentioned and bank connectivity too! You can connect your bank to your budget so your expenses and income stream right into your budget. You just drag and drop them to their correct budget line.

You’ll save time and won’t have to worry about forgetting a transaction or typing it in wrong! Faster and more accurate? Yes, please.

No matter what, you’ve got to budget. So get inside EveryDollar and get after it!