Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

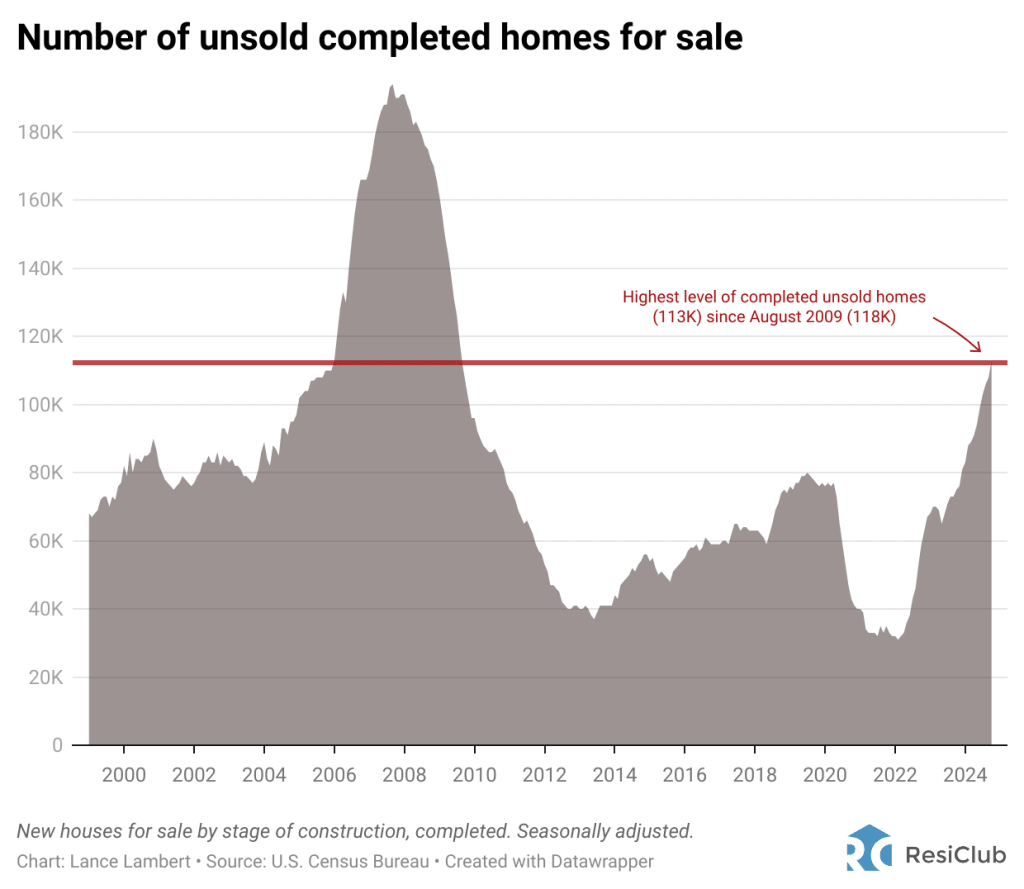

Since the pandemic housing boom fizzled out in 2022, the number of unsold completed new homes has been on a steady climb. The number of unsold completed new single-family homes in October 2024 (113,000) was the highest level since August 2009 (118,000)—although still far below the all-time high in September 2007 (194,000).

This raises the question: Is rising standing inventory simply a sign that the new construction market is normalizing after a historic pandemic housing boom, or do builders—particularly in areas where unsold inventory is increasing the most—need to make further affordability adjustments, such as cutting prices or offering greater incentives?

To get a better understanding, ResiClub rounded up three different perspectives explaining what the rise in unsold completed new home inventory means.

Click here to view an interactive version of the chart below.

1. Meritage Homes CEO says they’re building more spec inventory because they’re expecting a ‘strong’ 2025 spring market.

Speaking on CNBC in December, Phillippe Lord, CEO of publicly-traded homebuilder Meritage Homes, said that rising new home inventory isn’t bearish for builders.

“Inventory is definitely up across all the markets, both existing home inventory is slowly coming back and then new home construction is definitely up as well—but that’s really intentional by all of us [homebuilders],” Lord told CNBC. “We still see an opportunity to fill that void [not enough existing home supply] by providing move-in ready inventory for all these customers that can’t find that inventory in the existing home market, which is traditionally where they shop. So, a lot of new home builders are building more speculative inventory to really fill that void, and we’re all expecting a strong spring [2025] selling season based on what we’re seeing today.”

2. Housing analyst Kevin Erdmann thinks it’s a bullish—not bearish—sign for builders.

“Most of the time, the number of completed homes for sale rises because there is demand for them. That has never been more true than it is today,” Erdmann, who publishes the Erdmann Housing Tracker, tells ResiClub. “Normally, we might worry that at the end of a cycle, declining sales will lead to one last, unsustainable increase in completed homes for sale. In today’s market, builders need to keep working to add more completed home inventory so that sales can increase. Rising inventory is bullish [here].”

3. High standing inventory could prompt builders to offer discounts or slow down activity in Texas and Florida, suggests housing analyst Rick Palacios Jr.

“Homebuilders are heading into 2025 with the highest standing inventory since 2010. Elevated mortgage rates, more resale competition, and the new home industry’s push toward spec construction are all contributing forces,” Palacios Jr., director of research at John Burns Research and Consulting, wrote on LinkedIn last month.

“Standing inventory varies locally, with Florida, the Southeast, and Texas all at cycle highs according to our survey work,” he writes. “These three regions represent the meat of the new home market, so any strategic slowing of single-family starts due to this shifting supply backdrop will have major implications for overall industry growth numbers. We’re already seeing single-family starts activity cool more than expected seasonally through November.”