One day you’re walking across a stage in a cap and gown to receive your hard-earned diploma. And the next you’re forking over a chunk of your new paycheck to student loans.

While you can’t go back in time and tell your freshman self to avoid student loans (and to go easy on the pizza), there’s still a lot you can do now to get that debt out of your life.

One way to get on top of your student loans, especially if you’re juggling multiple payments, is by consolidating your student loans. But is it the right choice for you and your situation? Let’s find out!

What Is Student Loan Consolidation?

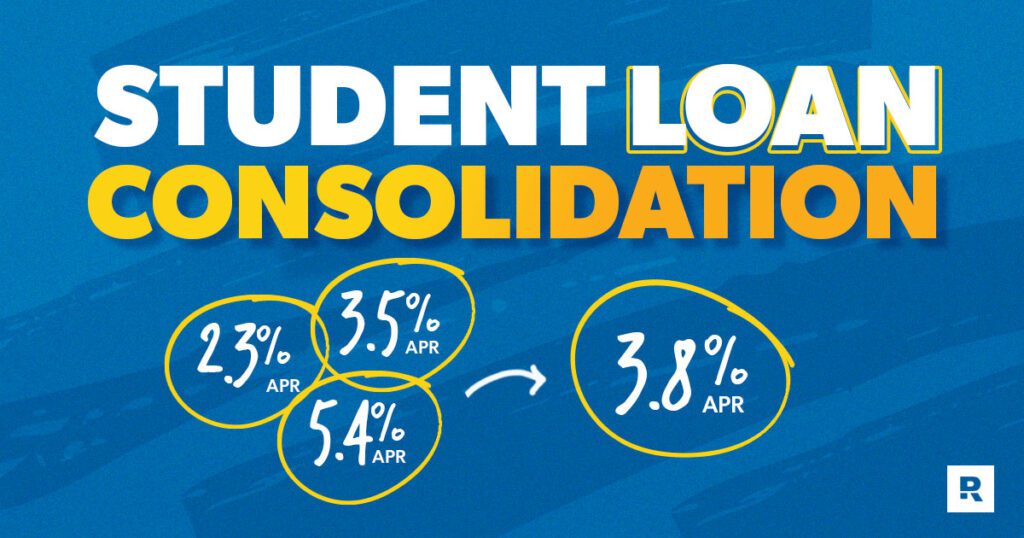

Student loan consolidation is the process of combining your different student loans into one new loan. Instead of having to pay multiple payments to multiple lenders, you only have to pay one monthly payment.

Technically speaking, only federal student loans can be consolidated. Everything else—so, private student loans or a mix of private and federal loans—has to be refinanced (which we’ll get into later).

Quick disclaimer: Student loan consolidation is the only form of debt consolidation we recommend—and only on a case-by-case basis. It isn’t right for everyone, and once you consolidate, it can’t be undone. So, be sure to read through all the pros and cons before you make your decision.

Should I Consolidate My Student Loans?

Consolidating Federal Student Loans

If you’ve got a handful of federal student loans, you might be eligible for student loan consolidation for free through the U.S. Department of Education. A Direct Consolidation Loan allows you to roll all of your federal loans into one loan. You also get a new, fixed interest rate.

Most federal loans are eligible for consolidation, but you don’t have to consolidate all your loans at once.

Some important things to know about consolidating your federal student loans:

You can only consolidate your federal student loans once.

You pretty much get one shot at consolidating your loans, so you need to have all your ducks in a row if you choose to go that route. Before you go through with the process, make sure you’re clear on how many federal loans you have and what their interest rates and terms are.

Now, there are some cases where you may be able to consolidate your federal loans again (for example, if you have loans that weren’t in the first batch you consolidated, or you defaulted on a Federal Family Education Loan (FFEL) Consolidation Loan). But as a general rule, consolidation is a one-time thing.

You can’t lower your interest rate when you consolidate federal student loans.

Consolidation can help you take variable rates and trade them for one fixed rate—which is nice! But this doesn’t necessarily get you a lower rate overall. A Direct Consolidation Loan takes the weighted average of all your current interest rates and rounds it up to the nearest one-eighth of a percent to get your new rate.1

There’s also no cap on the interest rate for a Direct Consolidation Loan. So, if you’re paying high interest rates on your student loans now, you’ll likely still be paying a high rate even after you consolidate.

Any unpaid interest is added to your principal balance.

If you have unpaid interest on your loans (usually because of deferment or forbearance), it will be added to your principal balance once you consolidate. That means you’ll be paying interest on a higher balance—which can add up faster. So, depending on how much unpaid interest you have, consolidating could end up costing you more in the long run.

Consolidating can affect your eligibility for income-driven repayment plans and Public Service Loan Forgiveness.

If you consolidate your federal student loans, you may lose credit for payments you’ve made toward an income-driven repayment plan. You’ll also lose any credit toward Public Service Loan Forgiveness (PSLF). And while you shouldn’t bank on these plans to solve your student loan problem, it’s worth knowing if you’re close to the finish line.

Consolidation usually extends the length of your loan.

You might end up with a lower monthly payment after consolidating. But that’s not a welcome gift from your new lender. No, that’s them extending your loan so you’ll pay more in interest over time. Sneaky, right? If you do choose to consolidate, you still need to attack your debt and pay more than the minimum payment each month. That’s the only way you’re going to rid yourself of student loan debt!

Consolidating Private Student Loans (or a Mix of Private and Federal)

If you’ve got private student loans, you can’t consolidate them with a Direct Consolidation Loan. But you can work with a private lender to combine your private loans into a new loan. This private student loan consolidation is called refinancing.

Ready to get rid of your student loans once and for all? Get our guide.

And if you’re like most graduates, you probably have a mix of both private loans and federal loans. But if you’re looking to roll them all into one, the answer’s the same if you only had private loans—refinancing.

Student Loan Consolidation vs. Refinancing: What’s the Difference?

Tomato, to-mah-toe, right? Uh, not quite. Student loan consolidation and student loan refinancing are two different things.

Like we said before, consolidation is only for federal loans, and refinancing is for everything else (private or a mix of private and federal). They both help you combine your loans and trade a variable interest rate for a fixed—which we always recommend. The only difference is that refinancing can actually get you a lower overall interest rate, while consolidating just averages your current rates.

So, if your rates and payment terms on your private loans are killing you, refinancing your student loans might be a good option. Once you find a lender, they’ll pay off your current loans and become your new lender. But you should only refinance your student loans if:

It’s free to refinance

You can get a lower interest rate

You don’t sign up for a longer repayment period

You won’t lose motivation to pay off your debt

Consolidation and refinancing may help you get a more manageable monthly payment. But your main goal should be to get those student loans out of your life—and that means throwing everything you can at them!

Is Student Loan Consolidation Worth It?

If you’re drowning in student loan payments, we know how hard it can be to keep your head above water. And while consolidation can give you some relief, it also has its downsides.

The main advantage of consolidating your loans is that it allows you to make one payment under one loan servicer. You’ll also get a fixed rate, which means you won’t have to worry about your lender jacking up your interest whenever they feel like it. Plus, consolidation can help you get out of a default if you’ve fallen behind on your student loans.

But keep in mind, consolidating won’t save you any money. It’ll actually cost you money if you lengthen the loan and only make the minimum payments. It’s basically a question of what will motivate you to pay off your student loans more: attacking one massive loan or several smaller ones? (It’s kind of like that age-old question: Would you rather fight a hundred duck-sized horses or one horse-sized duck?)

Some people love the convenience of a single payment and the stability of a fixed interest rate. But you might be better off keeping those loans separated and using the debt snowball method to motivate you to pay them off faster. (The goal is always speed and freeing up the wealth-building power of your income.)

Whether or not you decide to consolidate your loans, you can’t take your foot off the gas! Not even for a minute. Get laser focused, get on a budget. Telling your money where to go in advance gives you the power to cover the basics and make your student loan payments—instead of just hoping you’ll have enough. Plus, you can adjust your budget to throw even more at your loans so you can get them out of your life faster!

Go ahead and start budgeting for your student loan payments today!