Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

In the past few years, the housing market has experienced a “lock-in effect,” in which many homeowners with lower monthly payments and mortgage rates (some even below 3%) are unwilling to sell and purchase another home with a significantly higher monthly payment and mortgage rate. Last year, researchers from the Federal Housing Finance Agency estimated that the lock-in effect had resulted in more than a million “lost” home sales. But what mortgage rate would it take for homeowners to consider moving?

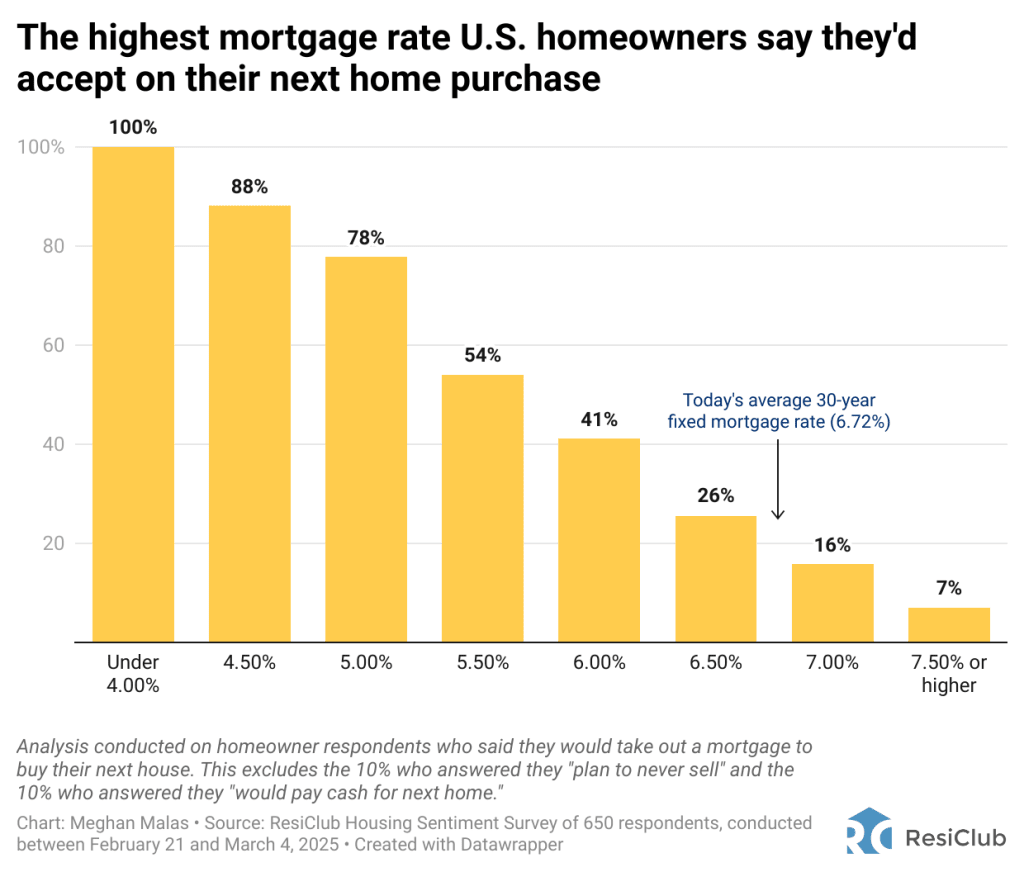

ResiClub aimed to find out with the ResiClub Housing Sentiment Survey. In total, 650 U.S. adults participated in the survey between February 21 and March 4, 2025. We asked U.S. homeowners—excluding those who said they “plan to never sell” or “would pay all cash” for their next home—what the highest mortgage rate is that they would accept on their next home purchase.

Only 16% of homeowners said they’d accept a mortgage rate up to 7% on their next purchase.

Just over half of homeowners (54%) said they’d accept a mortgage rate up to 5.5% on their next purchase.

Our biggest regret with this survey question is that we didn’t start conducting it quarterly or semiannually back in 2022. Our hypothesis is that, over time, as mortgage rates have remained higher for longer than consumers expected, the mortgage rate that potential homeowners—who are selling to buy—are willing to accept has been rising.

Some homeowners are realizing that sub-4% mortgage rates aren’t coming back anytime soon. And as they experience more lifestyle changes (like having more kids) and see increases in their incomes, their personal “switching costs” are shifting. Some are beginning to recognize that they’ll need to make a move at some point.

That said, homeowners aren’t going to sell and buy something new if they can’t qualify for or afford their next mortgage at current rates. And many homeowners who have the itch to move have come to realize they fall into that camp.

That raises the question: Where do U.S. consumers think the average 30-year fixed-mortgage rate will be at the end of 2025? The majority believe it will stay at 6% or above:

4% of U.S. adults said 7.5%

9% of U.S. adults said 7.0% to 7.5%

34% of U.S. adults said 6.5% to 7.0%

39% of U.S. adults said 6.0% to 6.5%

10% of U.S. adults said 5.5% to 6.0%

3% of U.S. adults said 5.0% to 5.5%

2% of U.S. adults said under 5.0%