It’s a story as old as time itself. You go to the mall, you buy a nice pair of jeans, but when you put them on at home they don’t quite fit as great as you imagined. It happens to all of us.

So, what do you do? You go back to the store, return the jeans, and they give you a refund. Then you get on with the rest of your day without giving it a second thought.

Did you bust out a victory dance after getting that refund? Did you throw a party with all your friends to celebrate? No, of course not. That would be silly. The store was just giving you your money back. That’s what a refund is, after all.

So, why do we act like kids on Christmas morning when the IRS gives us a refund? Think about it: When the IRS sends you that refund check, they’re just giving you your money back. That’s why it’s called a tax refund. We hate to break it to you, but Santa Claus doesn’t live in Washington, D.C.!

And the reality is that big fat refund you’ve been getting from Uncle Sam every spring could be costing you a lot more than the price of a nice pair of jeans.

What Your Tax Refund Is Costing You

Here’s the bottom line: When you get a tax refund, that just means you’ve been loaning the government money interest-free throughout the year—and they’re just returning money to you that was already yours. So, from now on, whenever you get a tax refund, I want you to imagine Uncle Sam saying, “Whoops, sorry about that! Here’s your money back.”

During the 2022 tax season, more than 110 million taxpayers received a tax refund and the average refund was $3,252.1 That means the average taxpayer had about $3,300 sitting there doing nothing in the IRS’s coffers all year! They could have put that money toward hitting their financial goals throughout the year.

Let’s say you’ve been receiving $3,000 tax refunds every year. That means you could have had an additional $250 in your paychecks every month. What exactly could you do with that extra cash? We can think of a few things!

Pay off debt faster. Whether it’s credit cards, car payments or student loans, adding almost $3,000 to your debt snowball throughout the year can make a huge difference and save you from accumulating all that interest.

Quickly build up an emergency fund. Every little bit counts! And the sooner you can get your 3–6 months’ worth of expenses socked away, the sooner you can start investing for retirement. Speaking of which . . .

Save more for retirement. Need to give your retirement savings a boost? An extra $250 invested each month for 20 years could add more than $200,000 to your nest egg! That way, your money is actually earning interest instead of sitting there doing nothing with the government until July.

Make extra payments on your mortgage. Life without a mortgage payment is a really sweet place to be and adding an extra $250 to each monthly mortgage payment can help you get there faster! Not only that, but you could also potentially save thousands of dollars in interest over the life of the loan.

Save for major purchases faster. Maybe you’re ready to replace that mattress you’ve had since college. Why wait until July to splurge? In just six months, you could have an extra $1,500 saved up for a new mattress. No more tossing and turning in the middle of the night!

We’ll say it again for those in the back: Getting a big tax refund is not a reason to celebrate. It just means you should have been getting a bigger paycheck all year.

Don’t settle for tax software with hidden fees or agendas. Use one that’s on your side—Ramsey SmartTax.

By adjusting your tax withholding, it’ll feel like you gave yourself a raise! But the key to making the most of it is to have a plan for the extra money you’ll see each paycheck. If not, that money will feel like it vanished into thin air and you’ll have no idea where it went.

You have to give each dollar an assignment with a budget, and there’s no easier way to do that than with EveryDollar, our free online budgeting tool.

Why You’re Getting a Tax Refund Every Year

When you get a chance, pull out your most recent paycheck. You’ll find a section labeled “Taxes,” which shows you how much your employer takes out of your paycheck and sends to the IRS to pay your fair share of federal income taxes. Those are your tax withholdings, because that’s how much your employer withheld from your paycheck for taxes. Makes sense, right?

The problem is, your employer might be withholding too much, meaning you’re overpaying the IRS throughout the year. So, when you fill out your tax return, the IRS will see that you paid them too much and send you a check for the difference in the form of a refund.

What you really want is to set your tax withholdings so that you owe nothing and get nothing from the IRS every year. That way, the government gets exactly what you owe in taxes from every paycheck—no more, no less. That’s the goal!

How to Stop Getting Big Tax Refunds

By now you should realize that a tax refund isn’t free money. It’s your money—money you should be receiving with your paychecks throughout the year. So, how do you stop getting a tax refund every year? Adjust your tax withholdings! Here’s how.

1. Add Up Your Withholdings

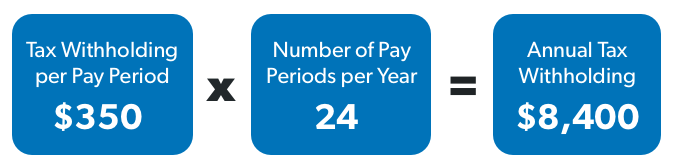

Get out your last paystub again and see how much your employer withheld for your federal income tax. Let’s say your employer takes out $350 each paycheck and you get paid twice a month. That means your employer is sending $8,400 to the IRS in taxes each year. Now you have to figure out if that’s too much or not enough.

2. Calculate Your Tax Liability

Your tax liability is how much you’ll owe in taxes throughout the year. If you’re single and your taxable income for 2023 is $50,000, that puts you in the 22% tax bracket and on the hook for about $6,307.50 in income tax.

3. Subtract the Difference

Now it’s time for some simple subtraction! Just take your annual tax withholdings and subtract your estimated tax liability. Using the example above, you’re potentially sending $2,092.50 more to the IRS than you need to. It’s time to fix that!

4. Adjust Your Withholdings

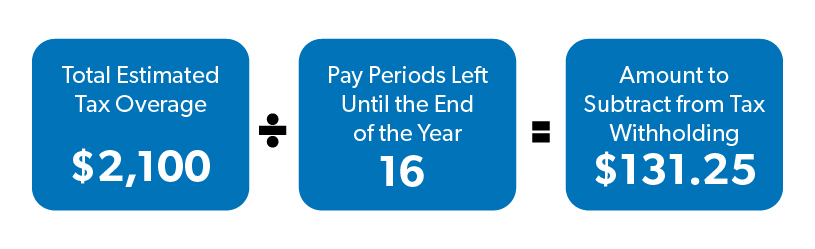

So, you’ve crunched the numbers and found you’ve been sending too much money to the IRS. Now what? Simply divide your estimated tax overpayment by the number of pay periods you have left before the end of the year to get your number.

So, for example, if you have 16 paychecks left and you have that $2,092.50 difference, your employer needs to withhold $130.78 less from each paycheck to get your tax withholdings just right.

To adjust your withholdings, you’ll need to fill out a new W-4 tax form, which tells employers how much tax to withhold from each paycheck. Before 2020, you could claim “allowances” on your W-4 that helped your employer figure out how much money to take out of your paycheck for taxes. The more allowances you claimed, the less money your employer withheld.

To make a long story short, there’s a redesigned W-4 form and you’ll notice there are no more allowances thanks to the Tax Cuts and Jobs Act. Instead, this new W-4 walks you through five steps that aim to account for all your income so that your employer can accurately calculate how much to take out of your paycheck for taxes. The IRS’s new tax withholding estimator can help you figure what changes you need to make on your new W-4.

There’s no two ways about it: All this tax withholding stuff is exhausting. Your best bet is to get in touch with a tax pro to figure out how much you need to adjust your tax withholdings and what you’ll need to put on your new W-4 to get it right.

After that, set up a meeting with someone in your employer’s HR department. Explain to them how much you want to adjust your withholdings and find out what you need to do to turn in a new W-4. They should be able to work with you to get that done!

Work With a Pro to Get Your Withholdings Right

Tax forms, tax withholdings, adding and subtracting . . . it’s a lot to process! And chances are you still have some questions about your tax situation and whether or not you really need to adjust your withholdings.

If you’re tired of huge tax refunds or getting smacked with a massive tax bill every year, our RamseyTrusted tax pros are here to help. They’ll sit down with you and help you take the guesswork out of tax withholdings! Find your tax pro today!

If your taxes are pretty straightforward and you want an easy-to-use tax software that can give you some peace of mind, check out Ramsey SmartTax! No hidden fees, no advertisements, no games. That’s how it should be!