Dive Brief:

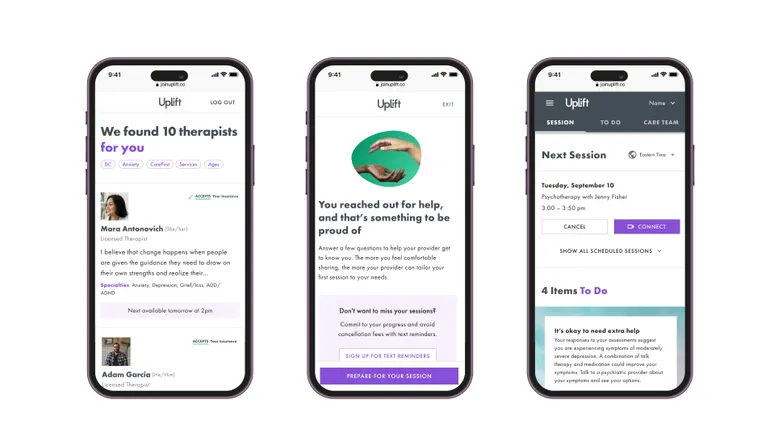

Teladoc Health is acquiring UpLift, a virtual mental health company, for $30 million in cash, the telehealth vendor said ahead of its first-quarter earnings on Wednesday.

The deal will speed Teladoc’s ability to accept insurance coverage for services under its direct-to-consumer mental health arm BetterHelp — a priority for the struggling business unit, which has dragged the vendor’s financial performance in recent months.

The purchase offers BetterHelp “a potential avenue out of the less-stable cash pay market,” Michael Cherny, an analyst at Leerink Partners, wrote in a Wednesday note. But Teladoc’s strategic shifts will take time to play out, and uncertainty in the broader economy could affect BetterHelp’s performance this year.

Dive Insight:

The purchase of UpLift, which includes up to $15 million in additional earnout consideration based on performance, closed Wednesday. The mental health firm, founded in 2020, recorded revenue of about $15 million last year, and going forward will be included in Teladoc’s BetterHelp unit.

The deal comes as BetterHelp, once a windfall for the business overall, has taken a hit as customers and revenue decline. In the first quarter, the unit’s revenue decreased 11% year over year to $239.9 million, while adjusted earnings before interest, taxes, depreciation and amortization was cut in half to $7.7 million. Paying users for BetterHelp fell 4%.

To right the ship, Teladoc has embarked on strategic changes at the mental segment, like offering a weekly pay option and moving to accept insurance coverage.

“While often more affordable than traditional in person therapy out of pocket, cost is a key reason cited by those not ultimately subscribing to BetterHelp, and many express an interest in accessing their covered benefits,” Teladoc CEO Chuck Divita said on an earnings call Wednesday.

That’s one area UpLift could help, executives said. UpLift already works with payers — including Aetna, UnitedHealthcare and Cigna — and has arrangements that cover more than 100 million lives, according to a press release.

UpLift will continue to manage and oversee its network of therapists that accept insurance, and BetterHelp therapists will also be considered for inclusion in the coverage network, Divita said.

Access to benefits coverage should lead to “significantly higher conversion rates” compared with cash pay, CFO Mala Murthy said. Plus, members will likely stick with BetterHelp longer due to increased affordability.

Still, the segment will continue to maintain a “sizable” cash pay business, which includes uninsured customers, those covered by an out-of-network payer and people who prefer direct payment, she said.

The UpLift purchase marks another deal for Teladoc, which also purchased virtual preventive care provider Catapult Health earlier this year. That acquisition could help funnel users toward Teladoc’s other offerings, including chronic condition management programs, a key area of investment for the telehealth company, executives said at the time.

In the first quarter, chronic care enrollment increased 3%. Teladoc’s integrated care segment, which includes its business-to-business virtual care offerings, recorded revenue of $389.5 million, rising 3% year over year, and adjusted EBITDA of $50.4 million, increasing 6%.

Overall, Teladoc revenue sank 3% to $629.4 million in the first quarter. Its net loss was $93 million, boosted by a $59.1 million non-cash goodwill impairment charge, linked to the value of the integrated care segment at the time of the Catapult acquisition.

Additionally, the company could face some challenges from tariffs this year — a problem shared by providers and medical technology firms.

The company sources some equipment from global markets, like connected devices and tools used for patient monitoring and virtual consultations in hospitals, Divita said. The company is pursuing tariff exemptions, pricing changes and looking for alternative sources, he added.

“We estimate a potential $5 million to $10 million headwind to adjusted EBITDA in 2025, largely in the second half,” Murthy said. “We will continue to monitor development and explore additional mitigation opportunities.”

Correction: A previous version of this story misstated the day the UpLift acquisition closed. It closed Wednesday.